Categories

Better together: Working across sectors to link anticipatory action and risk financing

Over the past decades, a suite of new disaster risk financing (DRF) tools have been generated across the development, the humanitarian and the private sector. Examples include index-based insurance, catastrophe bonds, forecast-based financing, pooled funds and many other innovations. Unfortunately, these innovative instruments have been developed largely in isolation of each other. Most of them are not integrated in comprehensive disaster risk financing strategies or linked more systematically to anticipatory action. They all serve different purposes, address different target groups and are based on different modalities – which has its advantages but also results in untapped potential, a loss of synergies, and risks leaving behind those who need the financing the most.

In March 2021, the Anticipation Hub, the InsuResilience Global Partnership and the Risk-Informed Early Action Partnership (REAP) teamed up to launch the “Sectoral Community on Linking Anticipatory Action to Risk Financing”. The objective of the Sectoral Community is to bring together the development & humanitarian sector, public & private actors, civil society actors, researchers and think tanks to exchange experiences and share ideas on how various DRF tools and anticipatory action can be better integrated.

Insights from the kick-off workshop

The inception phase, where we co-developed the TORs and drafted a research plan, concluded with the official kick-off workshop “Linking Anticipatory Action to Risk Financing” in September. The objective of this workshop was to bring this new community to life and start the conversation. It successfully raised awareness of the meaning of anticipatory action across the development and private sector, shared knowledge and lessons learned from the activities happening in the anticipatory action space, identified initial opportunities and challenges for collaboration and mapped out the next steps for the community.

More than 50 participants joined the workshop and welcomed the joint initiative by highlighting, amongst other aspects, the need to:

- Break silos, and work across sectors and organizations to advance climate and disaster risk finance instruments

- Challenge the short-term project-based nature of donor funding which tends to discourage more comprehensive, cross-cutting projects

- Combine different instruments through a layered approach so that the right funds are readily available in the right places, at the right time, for the different stages, severity and frequency of disasters

- Make greater use of the resources and capabilities of the private sector to scale up DRF and anticipatory action.

Via the link below you can find all the resources resources from the workshop including the report, presentations, recordings and interactive padlets.

Here you can find all the resources from the workshopInsights from the InsuResilience Annual Forum

Following the kick-off workshop, the Sectorial community reconvened at the InsuResilience Annual Forum in October. The Anticipation Hub organized a breakout session to learn from the Philippines – a country which is not only highly exposed to climate-related disasters but which is also known for being at the forefront of developing and investing in more innovative approaches to manage and address disaster risk. Speakers included representatives from the Red Cross Red Crescent Climate Centre, REAP, and Global Parametrics, and in the Philippines from the Food and Agriculture Organisation (FAO) and the Provincial Disaster Risk Reduction and Management Office (PDRRMO) in Davao de Oro Province. The full recording of the session can be accessed here.

Ben Webster, REAP Secretariat, outlined how the Sectoral Community is receiving growing interest from donors, private sector and humanitarian actors, highlighting the scope to collaborate to understand different approaches and identify how they can complement each other. Ben pointed out that experiences in the Philippines demonstrate the powerful progress already being made to integrate anticipatory action into national systems.

Maria Ruzzella (Zella) Quilla from FAO explained how this has come about and highlighted the role of the National Technical Working Group (TWG) on Anticipatory Action, co chaired by FAO and the Office of Civil Defence in the National Disaster Risk Reduction Council, in facilitating coordination and building awareness on how humanitarian agencies and government can harmonise their actions. Their ongoing advocacy work to institutionalise anticipatory action in the government has resulted in the TWG being proposed as a permanent committee of the government. However, the current policy environment is still limiting the extent to which funds can be accessed for anticipatory action at the national level. FAO and partners are writing a position paper to Congress to advocate for a shift in disaster financing to anticipatory approaches.

Randy Loy, PG Department Head of the Provincial PDRRMO in Davao de Oro Province in the Republic of the Philippines complemented the presentation, outlining how anticipatory action is being enabled through their government funding and planning mechanisms. Local Government Units (LGUs) can use 5% of their annual budget for preparedness activities. Memorandum 60, when fully operational, is expected to allow LGUs to access the Quick Response Fund (30% ) to take early action based on predicted impacts. In this case study you can read more about how other provinces in the Philippines are allocating funding for anticipatory action. To further encourage uptake with governments, Mr. Loy advised to continue to build awareness among key local actors, support linking early actions with local contingency, preparedness and disaster risk reduction planning and communicate the key messages on anticipatory action before, during and after the activation of protocols.

Mr. Toby Behrmann from Global Parametrics highlighted the work of the private sector by pointing to their work with Oxfam Philippines and Plan International (B-Ready Project) to support typhoon forecasting to trigger early actions ahead of impact. A crucial factor for private sector actors supporting risk financing is the certainty of the modelling and forecasts.

The Sectoral Community at the Global Dialogue Platform

The most recent meeting of the Sectoral Community was held in the context of the 9th Global Dialogue Platform on Anticipatory Humanitarian Action on December 8 2021. The session “Ways of working with the Insurance Sector to scale Anticipatory Action & Disaster Risk Finance” explored how can we utilise the insurance sector to scale up AA, looking at two specific opportunities: IFRC’s Disaster Emergency Relief Fund and Start Network’s Start Ready.

Dr. Nikolas Scherer from the Anticipation Hub & Lea Sarah Kulick from the InsuResilience Global Partnership (IGP) set the frame, exploring the audience’ knowledge around insurance and experiences working across sectors.

(Please click on an image to see it in full size.)

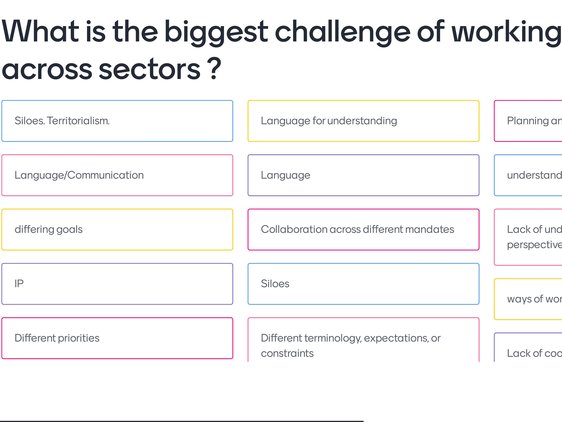

Participants were asked "What is the biggest challenge of working across sectors?"

Participants were asked "What is the first word that comes into your mind when you think of insurance?"

Participants were asked "What is the biggest challenge of working across sectors?"

Participants were asked "What is the first word that comes into your mind when you think of insurance?"

Lea introduced the “Sectoral Community Linking Risk Financing and AA” as a space to bring together the development and humanitarian sector with the goal to create a common language, foster innovations and exchange ideas on how to facilitate financing for AA. She outlined the plan for next year and invited participants to join the conversation.

Simon Meldrum from the British Red Cross (BRC) & Emma Karhan (AON) highlighted the role insurance can play in scaling up IFRC’s Disaster Emergency Relief Fund (DREF). With support from BRC, the Centre for Disaster Protection and AON, IFRC is currently working on a concept to expand the funding capacity of the DREF. Simon highlighted that humanitarian needs are growing while funding is failing to keep up. An insurance product would be one promising possibility to address this challenge. The DREF provides National Societies of the Red Cross Red Crescent network with funds to respond to crises as and, as of May 2018, pre-emptive funding through Forecast-based Action (FbA) protocols.

Clare Harris (Start Network) and Stuart Fraser (Insurance Development Forum) introduced Start Ready. The newly launched facility is based on three components: risk models, pre-agreed plans and pre-positioned financing. The innovation: various risks are pooled. Usually different pots of money are pre-positioned for crises that sit around unused. Start Ready tackles this problem layering various risk. That means it integrates various financing instruments (from national reserves to insurance) into one pooled financing mechanism. Through one entry point, donors can tackle a diversity of risks spanning multiple countries. You can read more about Start Ready here.

In a vibrant Q&A session, participants wanted to know more about the insurance structure, the triggers used, the evidence base around insurance more generally and if climate change is already factored into the actuarial model.

Next steps

The engagement and knowledge exchange facilitated through these sessions feed into a greater research plan for the sectoral community. The core goal is to come up with concrete policy recommendations on (a) how the climate and disaster risk financing community can help to scale up Anticipatory Action; and vice-versa, (b) how the Anticipatory Action community can contribute to strengthen risk financing initiatives. In the upcoming phase, we will work together and across sectors to develop answers to these questions.

The Sectoral Community is open to interested organizations and individuals. To learn more about these guiding questions and become part of this collaborative undertaking to address these, please reach out to

- Kara Siahaan (Anticipation Hub)

- Ben Webster and Emma Flaherty (REAP)

- Daniel Stadtmüller and Lea Kulick (InsuResilience Global Partnership)

This blog was written by Nikolas Scherer with contributions from Lydia Cumiskey, Kara Siahaan, Ben Webster, Emma Flaherty and Lea Sarah Kulick.